In 2024 I have made it a goal to bring to my clients, my friends and anyone who is interested in learning, all the things that one should know as a first time homebuyer or for those of you who are thinking about real estate investing. I have tried to think about the steps in the process, the questions that I receive day in and day out, and I hope to bring to you in short videos and articles all the steps in the process along with some frequently asked questions. So here we go!

Where do you start? Normally the answer to that question is “get prequalified.” and that is true. You should always get your prequalification before you get started so you know IF you are approved and for how much. I think though, we should even back up from there. How much can you afford, and are you ready? So, let’s start by putting together a plan:

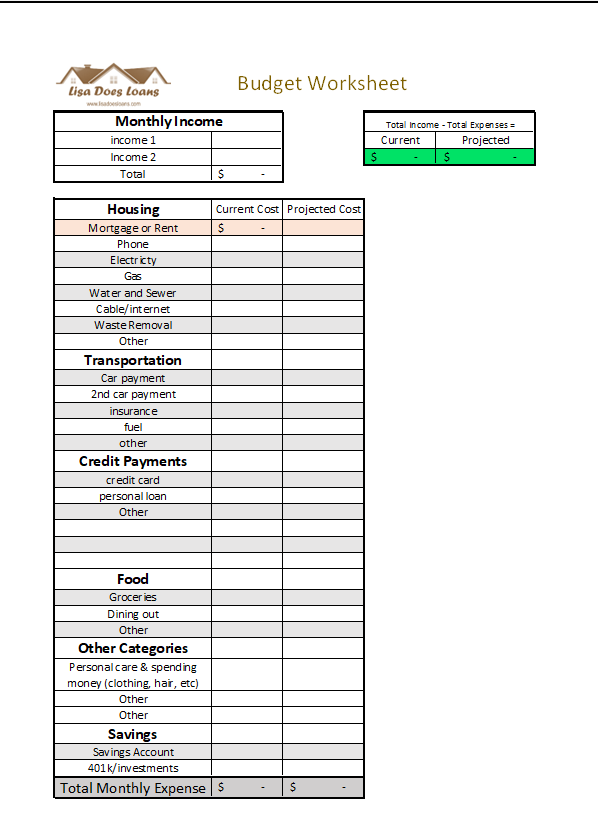

Take a look at your budget:

How much are you paying for your housing costs now? Are you wanting to spend about that same amount, or are you willing to spend a little more for something that will be yours and can build equity? I have a budget worksheet that I share with my clients who need help figuring out this question. I’ve put a form at the bottom of the page for you to download. You can take a look at the income that you receive, and what you are spending on your household expenses, liabilities and savings currently, and then in the second column you can estimate differences, discuss together with your family where and how you might economize to make this goal a reality. Let me know if you have any questions about the form, or need help talking through what your options might be.

Recommendations: Don’t be house poor. Think long term, if you are in medical school and your income in the next couple of years will double, then planning for the top of your pre-approval range might be a good idea. HOWEVER, most of us aren’t expecting a giant raise anytime soon, so be realistic. Don’t forget that you need money in the “savings” column, and discretionary or “spending money” is something you should always include as well.

Do you have money for upfront costs, down payment and closing costs?

The next step is to take a look at your savings. What do you have in the bank? When you are buying a house, you will have a need for cash out of pocket, and how much can depend on many things which we will go into later. Yes, I know that there are down payment assistance programs and there are loan types with zero down payment and there are certain strategies that we will get into later in this series to limit or even eliminate most of the cash out of pocket, but almost always there will be some cash requirement and you need to be prepared as best you can. We will talk about these specifics later in the series, as we discuss individual loan programs, scenarios and strategies, but for now, let’s look at the regular conventional loan process. Here’s what you need to know about the four categories of cash requirements:

Earnest Money:

Earnest money or the earnest deposit, is really an upfront cost, but it deserves its own distinctive category. Most houses require a good faith deposit on the real estate contract. This money tells the seller that you are serious about buying the home. This money is due when you go into contract on the home…so it’s required UPFRONT. The amount varies and can be anywhere from $500-$5000 and most of the time that amount is based on the home price, but there are other factors which we can discuss later in the series.

Down Payment:

This category is often confused with earnest money/earnest deposit but the down payment is NOT a deposit that is required upfront to the seller. Rather this money pays DOWN the principal of the loan you are applying for and will be collected when you close on the home as part of your “cash to close.” Down payment amounts vary based on a couple of factors, the requirements of the loan can be anywhere from 0%-25% of the purchase price, though most government loans require only 0-5%. Many times, even if the requirement is lower, I will recommend 20% if my client has the funds, to avoid paying a monthly mortgage insurance, which will keep your monthly payment lower. Figuring how much down is extremely individualized, it’s about requirements and about doing the math to see whether it is more beneficial doing it one way versus another. More on THIS later too, but just remember, THE STRATEGY is what I’m here for and where I excel. I will be the expert in your corner and give you the options to help you choose the best loan scenario for you and your family.

So as you are working through your budget, I would figure 5% of purchase price as a good rule of thumb, unless you are self-employed, looking for an investment property or are an atypical buyer in some other way. You can always reach out and I can help you to budget a better amount for your specific scenario. Just give me a call, 918-316-7237.

Upfront costs in contract:

Again, this is individualized to each transaction, but it is something you should prepare for. With very few exceptions, every loan will require an appraisal. You should expect between $500-800 depending on the property and other factors. You may or may not be required to have a home inspection, but I would recommend that everyone get one unless you are willing to gamble on such a large investment. These usually average between $250-$500 depending on the company and the property inspected. Pest inspections are also encouraged, even if not always required. These range from $85-$250, so again, unless you are a gambler, it’s just a good idea to budget for this. There are other inspections that COULD be required, but specific to the property itself. We will get into those more later in the series, but for our budgeting purposes, I would figure on a range of: $1000-$2500 to get you started in this category.

Closing Costs:

Finally, we get to the fourth and final category of home buying expense and that’s closing costs. We will delve into this topic much deeper as its own topic later, but for now know that closing costs are not due until the day of closing. These include the cost of the loan, all third party costs, your prepaids and taxes. A good rule of thumb for budgeting purposes in this category is 3-5% of purchase price.

Now, my purpose of reviewing this information isn’t to scare you. There are numerous ways to reduce or even eliminate some of this cash out of pocket, BUT to prepare you for what lies ahead as you are in this planning phase, it’s best to know that in all likelihood you will need at least some of this money and you need to know where it’s coming from. We will get into that more too as we talk about down payment assistance programs, what can be negotiated in a contract, gifts from family and the ways to source these. There are so many ways to make the magic happen.

Next week we’ll talk about the next step, getting prequalified. Usually these two steps can be done together, as I can help you figure out how much money you REALLY need to prepare for based on the other individual aspects of your personal situation and goals. But if your goal is homeownership in 2024, use this week to really nail down the budget of what you can afford, and see what money you have available now. Next week we can talk about what to do with that information, how to get prequalified, and then how to set up our timeline so that in the coming weeks we can bridge the gap from here to homeowner!