The #1 thing that I hear from clients about why they haven’t bought or investigated buying a house before now is, “well I wasn’t sure about my credit score.”

Credit is more than just a number though. You may be surprised to know that it’s not even the most important thing that is weighed. Don’t get me wrong, the number is important, but it doesn’t have to be high. What’s in the credit report (late payments, lots of debt, etc) are much more heavily weighed than the number. So, let’s talk about the credit report and what it all means.

What’s the score?

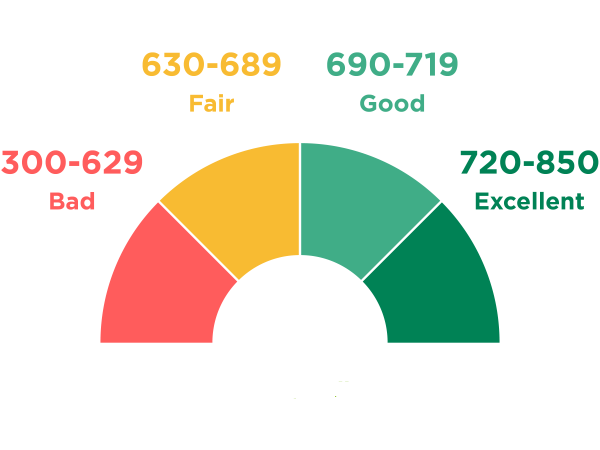

Your credit score is a three digit number that “scores” the information in your credit report. These numbers range from 300-850 and there are different tiers considered: poor, fair, good, and excellent. The qualifying ranges for those assigned descriptors can vary with who is looking at the score. Some lenders are more forgiving than others.

Typically:

Tier 1 (best) 720-850

Tier 2 (good) 690-719

Tier 3 (fair) 630-689

Tier 4 (poor) 300-629

We can work with some lower credit scores , but if your score is Tier 3 or better, then you can qualify for a better interest rate, saving you money. When I speak with you and check your credit, I will let you know what your credit score is. If you are close to breaking into a new tier, sometimes I will advise you some things to do to break through to the next level, before you buy, if there is time. That is another reason that it’s good to check into your finances BEFORE you start shopping for your home.

Where does the score come from?

There are three agencies that report credit: Experian, Trans Union and Equifax. When we look at your credit, we use the MIDDLE score of the three. You might wonder, how do these agencies get your information. Creditors that you have for your credit cards, loans, etc may report your credit to one or more of these companies every month when you make (or don’t make) your payment. Some only report to one agency, or they may only report bad credit (late, no pay, etc)

There are five main factors that impact your credit:

Payment history

Credit utilization

Length of credit history

Inquiries/new credit established

Diversification of types of credit

Correcting & Improving Scores

When we have a consultation, I look over your stated income, assets and credit and will let you know what I find. If you are qualified, then we can have a discussion about budget, and set a price range goal for your house-shopping. If you aren’t qualified, then I can’t say yes to the loan YET, but that doesn’t mean I’m saying no forever. With a little work, this is something that we can do in a few months. I will help you create goals and milestones, and we will work to get you where you need to be. You can call me when you have questions, or just need a cheerleader to get you through to the next phase. I want to work with you and help you get to the point where the underwriters will tell us, “YES!” on your loan.

Some reasons for credit denial:

Low credit score

Too many collections

High Debt to Income Ratio

Too short a time of employment

Top 3 tips:

Pay your bills on time–No Lates—make sure that you aren’t late on any payments. Nothing can kill your credit faster than missed or late payments.

Stay under 30% (max) balance on credit cards: Staying at or below that 30% of available balance will be extremely helpful. Make sure you do this with any credit card that you have and watch your scores go up quicker. Staying under 10% is even better, but harder to do in real life.

Do not close open lines of credit: Available credit (while using at most less than 30%) is the name of the game. Even if you aren’t using those credit cards, don’t close the accounts. Leave them open for that open balance and available credit to give you an edge.

Want to know more? I’d love to be your cheerleader as you strengthen your position as you’re getting ready to purchase or refinance a home. If you have ANY questions please don’t hesitate to call, email or text me. Reach out, talking is always free!